If you can safe a lower life expectancy interest, then it a far greater alternative than just a personal bank loan

- Prequalification for your personal bank loan: Prequalifying for a consumer loan with different lenders will enable you evaluate potential even offers. Might located an estimated annual effective rate, that is a far greater level than rates whilst requires into account financing fees a loan provider might have. You should also determine if per bank charge a keen first fee.

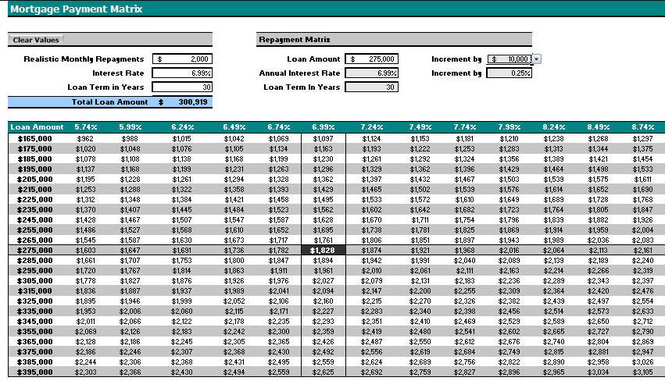

- Regulate how far money you ought to borrow: Before you apply having a personal bank loan, assess the quantity you ought to borrow. You are able to a personal bank loan calculator so you’re able to estimate just how much their monthly mortgage payments is.

- Sign up for your personal loan: When you have currently found the lender, therefore concur with the commercial conditions they give your, apply for the loan truly otherwise on line. The lender have a tendency to ask you to promote personal data, like your earnings, target, and you may social protection count (SSN). If you intend to utilize myself, delight label to come to ascertain the necessary files you must bring to be sure your earnings otherwise house.

- Feedback and you may indication the mortgage offer: This point is essential. When your lender approves your loan software, they will give you financing agreement for your remark. Dont skimp into a rigid report on the fresh new price. We recommend payday loans without bank account in Heeney that your reassess the quantity expected, incase it’s necessary for your financial believed, inquire about the money. In case your response is however sure, you just have to sign it. Up coming, might located your loans.

- Pay-off your very own mortgage: It seems noticeable, it cannot harm to help you encourage you the way to protect your own currently busted credit history. Make sure to repay a financing when you look at the repaired month-to-month installments. Certain loan providers provide discount fees for folks who register for automatic percentage. And, automatic payment will guarantee that you never skip a cost and ergo enhance your credit history.

If you have already tried new steps to qualify for a great personal loan after bankruptcy proceeding and it didn’t go really or if you need a lower life expectancy interest rate, take into account the following the choices for borrowing currency:

Whenever you can safe a lower interest rate, it a far greater option than just a consumer loan

- Protected Credit cards: The real difference away from a typical credit card is that covered borrowing cards need a refundable cash put. Instead of which have a borrowing limit which is predicated on your creditworthiness, their seller basics its limit for the amount of cash you put when you look at the a guarantee account. Like other forms of covered debt, the lender normally seize finances deposit if you’re unable to spend the money for count which you lent. Which means that you have got power over the debt.

If you would like rebuild their credit immediately following bankruptcy, this is a good option. Once we mentioned before on this page, and then make money punctually is replace your credit history, helping you qualify for upcoming loans.

Whenever you can safe a lower interest, it a better alternative than simply a consumer loan

- Domestic Security Credit line: A property equity personal line of credit allows you to borrow funds as needed from your residence’s guarantee. At the beginning of the mortgage, there was a withdrawal several months in which you are just responsible in making the attention repayments. At the end of the fresh withdrawal months, brand new fees several months starts. You are accountable for spending dominant and interest balances with this time.

So you’re able to be considered because the eligible, loan providers require you to provides between 15% and you may 20% of house’s equity. Because your house protects their credit line, lenders can be essentially promote lower rates of interest.

Leave a Reply